London's Water and Sewage services are owned and run purely by a Private "water" company called Thames Water. UK Government does not fund "Thames Water", therefore the only people paying for the upgrade of the Sewer network in London are its own shareholders and customers (via a levy charge on their water bills).

Once again the so called "Wee ginger Dug" (Paul Cavanagh) has a direct hand in spreading this deliberate lie just as he did with his direct involvement in directly making up and spreading the "Whisky Export Lie" Can be see on this Link Wee Ginger Dug Whisky Export Tax Lie

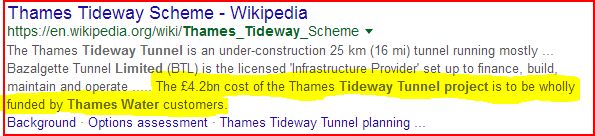

Information from Thames Waters Website is below from the time but this "Customer News" is no longer on their own website, but the information on it can still be found on Wikipedia and the link is included here as well.

https://en.wikipedia.org/wiki/Thames_Tideway_Scheme

https://corporate.thameswater.co.uk/About-us/Thames-Tideway-Tunnel/Who-will-pay-for-it

===================================================================

"We’re always working to modernise our water and sewer networks throughout London and the Thames Valley to ensure they can cope with the demands of the future.

One of the biggest projects to future-proof our network is the Thames Tideway Tunnel.

This is a 15-mile-long sewer, the width of three London buses, which will run beneath the River Thames in London. It will capture millions of tonnes of sewage, which would otherwise overflow into the river from the capital’s overloaded sewer system.

The tunnel will then transfer the sewage to our Beckton works where we will treat it and return the clean water safely back into the environment. This huge project is being delivered by a separate company, known as Tideway, and will be completed by 2023.

Why it’s important

The tunnel will bring lots of benefits, including:

- It will collect nearly all of the 18 million tonnes of sewage that pollutes the tidal River Thames in a typical year

- We will use the sewage to generate additional renewable energy

- It will ensure a healthy river environment for you and future generations

- Our world-leading capital will have a world-leading sewer system

What’s the cost?

Here’s how we’re keeping your costs down and how the project is being funded:

- Around £13 of the average household bill for 2016/17 will go towards the project

- This amount will eventually rise to no more than £25 a year, before inflation

- We’re making savings elsewhere to keep your wastewater bill around the current price, before inflation, until at least 2020"

- ------------------------------------------------------------------------------------------------------------------------

- https://corporate.thameswater.co.uk/About-us/Thames-Tideway-Tunnel/Who-will-pay-for-it

- So it can be clearly seen that the whole cost of this is only being paid for by Thames Waters Shareholders and its very own served local private water company customers.

- Another Scot Nationalist Lie blown out of the Water

More information on ThamesWater (who own the London Sewer system) can be found by clicking this link below.

More information of Scottish Nationalist "Infrastructure Costs" debunking here

========================================================================

#SNPcult #Scotland

# Rangers#Celtic#SNPLies #Oil Revenues #Stolen Scottish Oil

#Photooftheday #Dundee #Yescity #Glasgow#Dundee #Aurora #Cats #Dogs #Mull #Skye

#Yessnp #Yes #celebsforindy #Tech #SNPcult #Cults #ScottishResistance #DavidIcke

#Hamilton #Larkhall #Stonehouse #Nairn #Culloden #Inverness #Fracking

#BBCScotland #Cybernats #Goebbels #gbxfriday #wetsfans #everton

#BrynTeilo #Stolen Oil #Scottish Oil #Wee Ginger Dug #GERS #Gers #Gers